Tax Brackets Belgium . personal income tax has progressive tax rates. the belgium tax calculator below is for the 2024 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in belgium. This means that the higher your income is, the higher the rate of tax you pay. The tax tables below include the tax rates, thresholds and allowances included in the belgium tax calculator 2023. Living and working in different eu member states; Taxation on a sliding scale is applied to. The most important taxes are collected on. the income tax rates follow a progressive scale, ranging from 25% for individuals earning under €15,200 and reaching 50%. personal income tax is calculated by determining the tax base. Living and receiving pensions in. This includes calculations for employees in belgium to calculate their annual salary after tax. taxation in belgium consists of taxes that are collected on both state and local level.

from www.wgrz.com

personal income tax is calculated by determining the tax base. the belgium tax calculator below is for the 2024 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in belgium. Living and working in different eu member states; the income tax rates follow a progressive scale, ranging from 25% for individuals earning under €15,200 and reaching 50%. taxation in belgium consists of taxes that are collected on both state and local level. The tax tables below include the tax rates, thresholds and allowances included in the belgium tax calculator 2023. personal income tax has progressive tax rates. This means that the higher your income is, the higher the rate of tax you pay. Taxation on a sliding scale is applied to. Living and receiving pensions in.

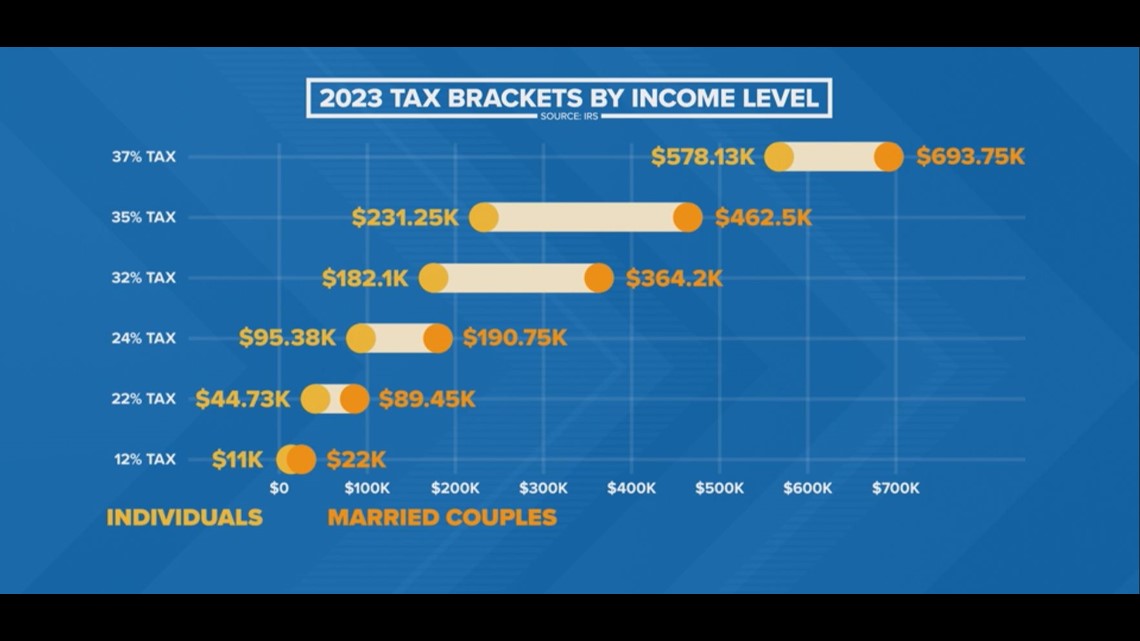

IRS changing tax brackets, standard deductions going up in 2023

Tax Brackets Belgium personal income tax has progressive tax rates. the belgium tax calculator below is for the 2024 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in belgium. This means that the higher your income is, the higher the rate of tax you pay. the income tax rates follow a progressive scale, ranging from 25% for individuals earning under €15,200 and reaching 50%. The most important taxes are collected on. Living and working in different eu member states; The tax tables below include the tax rates, thresholds and allowances included in the belgium tax calculator 2023. This includes calculations for employees in belgium to calculate their annual salary after tax. Taxation on a sliding scale is applied to. Living and receiving pensions in. personal income tax has progressive tax rates. taxation in belgium consists of taxes that are collected on both state and local level. personal income tax is calculated by determining the tax base.

From www.youtube.com

Tax in Belgium with brackets. One of the highest taxes in Europe Tax Brackets Belgium This means that the higher your income is, the higher the rate of tax you pay. The most important taxes are collected on. Living and receiving pensions in. personal income tax is calculated by determining the tax base. Living and working in different eu member states; personal income tax has progressive tax rates. This includes calculations for employees. Tax Brackets Belgium.

From lyfeaccounting.com

New 2021 Tax Brackets You Need To Know About Overview) Tax Brackets Belgium Living and receiving pensions in. The most important taxes are collected on. personal income tax has progressive tax rates. This means that the higher your income is, the higher the rate of tax you pay. the belgium tax calculator below is for the 2024 tax year, the calculator allows you to calculate income tax and payroll taxes and. Tax Brackets Belgium.

From belgiumsolved.com

Tax Brackets in Belgium Explained [June 2024 Update] Tax Brackets Belgium This includes calculations for employees in belgium to calculate their annual salary after tax. Taxation on a sliding scale is applied to. The most important taxes are collected on. personal income tax is calculated by determining the tax base. The tax tables below include the tax rates, thresholds and allowances included in the belgium tax calculator 2023. Living and. Tax Brackets Belgium.

From www.taxback.com

Your nononsense guide to Belgian tax refunds! Tax Brackets Belgium the belgium tax calculator below is for the 2024 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in belgium. the income tax rates follow a progressive scale, ranging from 25% for individuals earning under €15,200 and reaching 50%. This includes calculations for employees in belgium to calculate their annual salary after. Tax Brackets Belgium.

From goldiebphaidra.pages.dev

Tax Calculator 202425 Guenna Joelly Tax Brackets Belgium The tax tables below include the tax rates, thresholds and allowances included in the belgium tax calculator 2023. the belgium tax calculator below is for the 2024 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in belgium. taxation in belgium consists of taxes that are collected on both state and local. Tax Brackets Belgium.

From www.saverlife.org

What Are Tax Brackets & How Do They Affect Your Money? SaverLife Tax Brackets Belgium taxation in belgium consists of taxes that are collected on both state and local level. The most important taxes are collected on. Taxation on a sliding scale is applied to. Living and receiving pensions in. personal income tax is calculated by determining the tax base. Living and working in different eu member states; This means that the higher. Tax Brackets Belgium.

From www.aol.com

Here's how the new US tax brackets for 2019 affect every American Tax Brackets Belgium Living and working in different eu member states; The tax tables below include the tax rates, thresholds and allowances included in the belgium tax calculator 2023. The most important taxes are collected on. the income tax rates follow a progressive scale, ranging from 25% for individuals earning under €15,200 and reaching 50%. the belgium tax calculator below is. Tax Brackets Belgium.

From tradingeconomics.com

Belgium Taxes On Profits And Capital Gains (current LCU Tax Brackets Belgium taxation in belgium consists of taxes that are collected on both state and local level. Taxation on a sliding scale is applied to. Living and working in different eu member states; personal income tax has progressive tax rates. the belgium tax calculator below is for the 2024 tax year, the calculator allows you to calculate income tax. Tax Brackets Belgium.

From www.oecd-ilibrary.org

Belgium Taxing Wages 2021 OECD iLibrary Tax Brackets Belgium personal income tax is calculated by determining the tax base. This includes calculations for employees in belgium to calculate their annual salary after tax. The tax tables below include the tax rates, thresholds and allowances included in the belgium tax calculator 2023. Taxation on a sliding scale is applied to. The most important taxes are collected on. the. Tax Brackets Belgium.

From link2europe.eu

Guide to paying tax in Belgium Link2Europe Tax Brackets Belgium personal income tax has progressive tax rates. the income tax rates follow a progressive scale, ranging from 25% for individuals earning under €15,200 and reaching 50%. Taxation on a sliding scale is applied to. personal income tax is calculated by determining the tax base. Living and receiving pensions in. The most important taxes are collected on. Living. Tax Brackets Belgium.

From www.freidelassoc.com

2018 Tax Rates Do You Know Your New Tax Bracket? — Freidel Tax Brackets Belgium Taxation on a sliding scale is applied to. taxation in belgium consists of taxes that are collected on both state and local level. Living and receiving pensions in. This means that the higher your income is, the higher the rate of tax you pay. The most important taxes are collected on. This includes calculations for employees in belgium to. Tax Brackets Belgium.

From fabalabse.com

Does Belgium have high taxes? Fabalabse Tax Brackets Belgium The most important taxes are collected on. Living and working in different eu member states; the income tax rates follow a progressive scale, ranging from 25% for individuals earning under €15,200 and reaching 50%. the belgium tax calculator below is for the 2024 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions. Tax Brackets Belgium.

From www.schwab.com

How Do Tax Brackets Actually Work? Charles Schwab Tax Brackets Belgium Living and working in different eu member states; taxation in belgium consists of taxes that are collected on both state and local level. This means that the higher your income is, the higher the rate of tax you pay. the belgium tax calculator below is for the 2024 tax year, the calculator allows you to calculate income tax. Tax Brackets Belgium.

From www.wgrz.com

IRS changing tax brackets, standard deductions going up in 2023 Tax Brackets Belgium This includes calculations for employees in belgium to calculate their annual salary after tax. the belgium tax calculator below is for the 2024 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in belgium. Living and receiving pensions in. Living and working in different eu member states; The tax tables below include the. Tax Brackets Belgium.

From www.plan-wisely.com

2018 Tax Brackets Plan Wisely Tax Brackets Belgium Living and receiving pensions in. This includes calculations for employees in belgium to calculate their annual salary after tax. the belgium tax calculator below is for the 2024 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in belgium. The tax tables below include the tax rates, thresholds and allowances included in the. Tax Brackets Belgium.

From www.pinterest.com

Your 2023 Tax Brackets vs. 2022 Tax Brackets Tax brackets, Tax Brackets Belgium The tax tables below include the tax rates, thresholds and allowances included in the belgium tax calculator 2023. taxation in belgium consists of taxes that are collected on both state and local level. Living and receiving pensions in. Living and working in different eu member states; the belgium tax calculator below is for the 2024 tax year, the. Tax Brackets Belgium.

From beaconwc.com

Beacon Wealthcare 2023 Contribution Amounts, Tax Bracket Changes, and Tax Brackets Belgium personal income tax has progressive tax rates. Living and receiving pensions in. taxation in belgium consists of taxes that are collected on both state and local level. Taxation on a sliding scale is applied to. The tax tables below include the tax rates, thresholds and allowances included in the belgium tax calculator 2023. the belgium tax calculator. Tax Brackets Belgium.

From news.pwc.be

Everything you need to know about the new special tax regime in Belgium Tax Brackets Belgium The tax tables below include the tax rates, thresholds and allowances included in the belgium tax calculator 2023. taxation in belgium consists of taxes that are collected on both state and local level. the income tax rates follow a progressive scale, ranging from 25% for individuals earning under €15,200 and reaching 50%. The most important taxes are collected. Tax Brackets Belgium.